Deepening Rural Financial Inclusion through Expansion of Banking Agents

By Julia Seifert, Research and Insights Consultant, FSDT

In Tanzania’s dynamic financial landscape, the need to enhance access to banking services in rural areas is not merely a challenge, but also presents a significant opportunity for achieving economic progress. As Tanzania aspires to ensure that all its citizens are financially included, the key role of banking agents becomes increasingly evident in the context of rural Tanzania.

This article examines the transformative potential of strategically expanding the number of banking agents, and integration of technology, innovative financial approaches, and the local workforce to harness a tangible impact. Our goal is to advocate for the rural communities, build resilience, and foster prosperity in areas often overlooked by formal financial services. Embracing this mission goes beyond just closing the urban-rural financial gap, but also shaping a future where financial systems work more effectively for everyone in Tanzania.

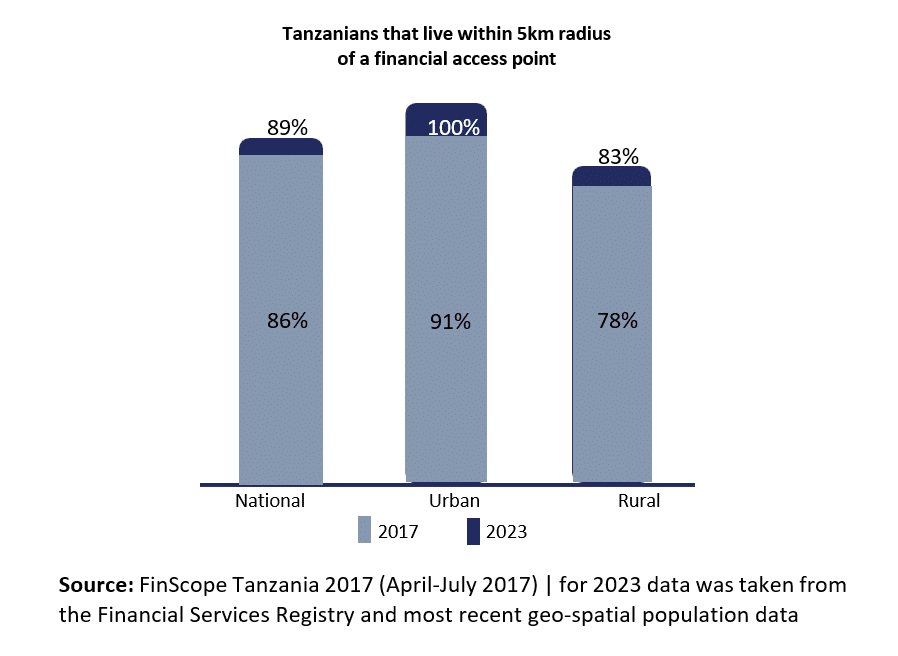

89% of Tanzanians Live Within 5km of a Financial Access Point

Data from the Financial Services Registry (FSR) indicates that in 2023, 89% of Tanzanians resided within 5 km of a financial access point. Though this is a tremendous improvement in proximity since 2013/14, whereby barely 45% of Tanzanians lived within 5km radius of a financial access point; most of this improvement is driven by mobile money agents. Only 11% of all the financial access points are providing bank agent services, while 82% of the banking agents are simultaneously mobile money agents. This indicates that banking agents play mainly an ecosystem and financial deepening role other than providing primary access to financial services. However, this deepening is significantly lower in rural areas, where overall financial services’ penetration remains lower, at 83%, and challenges that hinder effective penetration of banking agents persist to exist. We will delve into these challenges, shedding light on the factors that contribute to the suboptimal reach of banking services in these remote regions. Understanding these challenges is crucial for devising targeted strategies to enhance the impact and reach of banking agents in Tanzania’s rural landscape.

Availability of 3G and 4G Networks

The limited reach of 3G and 4G networks in Tanzania creates a significant barrier to the widespread deployment of banking agents, especially in rural areas. In areas where these networks struggle to reach, the connectivity needed for banking transactions becomes unreliable or non-existent. Banking agents rely heavily on a stable internet connection to facilitate crucial financial services. The lack of reliable 3G and 4G coverage hinders their efficiency, making it challenging to offer seamless services such as mobile banking, fund transfers, and account management in remote locations. To foster financial inclusion, it is essential to enhance the penetration of 3G and 4G networks, ensuring that reliable internet services are accessible across the country.

A recent report from the Tanzania Communication Regulatory Authority (TCRA) has revealed that there is significant progress in spreading internet coverage across the country. The report highlights that the coverage of 3G and 4G networks to be at approximately 75%; however, this penetration has not been in a favor of most of the rural places, where gaps persist.

Breaking Barriers:

The Affordability Dilemma of Point of Sale (POS) Machines

An Essential Toolkit for Banking Agents:

In the toolkit of banking agents navigating the financial landscape of Tanzania, the Point-of- Sale (POS) machine plays a pivotal role. Complemented by other tools such as card readers, mobile phones, barcode scanners, PIN pads, and occasional personal computers, these ma- chines facilitate crucial financial transactions. However, their affordability remains a significant concern, particularly for agents operating in rural areas.

The High-cost Barrier:

In Tanzania, the price of a POS machine ranges from TZS 575,000 to TZS 690,000, presenting a formidable financial hurdle for banking agents. This cost, while justifiable in urban contexts, becomes a substantial challenge for agents in rural areas where financial resources are often limited. The high costs associated with these tools can potentially hinder agents from acquiring the necessary equipment, limiting their ability to extend essential financial services to underserved communities.

Addressing the affordability of POS machines is paramount for fostering the widespread adoption of banking agents, especially in Tanzania’s rural landscapes. As we confront the affordability dilemma, the goal is to empower agents with the tools they need to bridge financial gaps and contribute to the overarching mission of enhancing financial inclusion in communities where it matters most.

Bridging Financial Divides:

Empowering Banking Agents in Rural Tanzania

Capital Challenges in Diverse Landscapes:

Banking agents face capital problems depending on where they work. Whether in busy cities, quiet towns, or places in between, getting enough money to raise their capital is tough. This is especially true for rural areas where not having sufficient capital makes it difficult for agents to work, unlike those in busy cities.

Rules and Regulations Making a Difference:

To close the financial gap and make banking accessible by everyone, by everyone, hence regulators may consider reassessing in particular banking agent regulations to further enable for digital rules and regulations that will serve as enablers for digital banking services in the country. CGAP’s focus note on Basic Enablers for Digital Financial Services (DFS), which combines insights from research and policy discussions, has suggested that some of these basic enablers can include:

- Nonbank E-Money Issuance:

A basic requirement is to create a specialized licensing window for nonbank DFS providers— EMIs—to issue e-money accounts (also called prepaid or stored-value accounts) without being subject to the full range of prudential rules applicable to commercial banks and with- out being permitted to intermediate funds. - Use of Agents:

DFS providers—both banks and nonbanks—are permitted to use third-party agents such as retail shops to provide customers access to their services. - Risk-Based Customer Due Diligence (CDD):

A proportionate anti-money laundering framework is adopted, allowing simplified CDD for lower-risk accounts and transactions. The latter may include opening and using e-money accounts and conducting over-the-counter (OTC) transactions with DFS providers. Further, location based tiering of capital requirements for agents may be considered to encourage rural penetration. - Consumer Protection

Consumer protection rules are tailored to the full range of DFS providers and products— providing a necessary margin of safety and confidence.

Price Tiered Location-Based and Behavioral Change:

Apart from primary access barriers, the use of banking agents may also be hindered by the costs of transactions encountered while using such services. Such costs may deter customers, especially those in the rural areas, from using these services as they would com- pare such costs with the using cash as a means of transacting. Hence, fostering behavioral change by providing more affordable formal financial services is paramount. This can be achieved by providing tiered tariffs for rural customers. Tanzania is no stranger to this concept, just as how “Tariffs za Chuo” (University Tariffs), an airtime package initially designed for university students, but ended up benefiting anyone within the proximity of the univer- sities. Similarly, banks may design rural tariffs which differ from the urban ones to encourage adaption of the service by a large group of rural inhabitants, before normal charges are re-introduced once behavioral change is achieved.

In conclusion, the expansion of banking agents in the rural areas can act as a key enabler for deepening financial inclusion in the country for national economic transformation. There are significant opportunities for financial service providers, policymakers, and other private sector players to collaborate in this initiative to ensure a wider and sustainable reach of relevant and affordable banking services to the rural areas. FSDT is keen to convene different partners in the financial sector and beyond to help increase access and usage of banking services to Tanzanians in the rural areas, especially women and youth farmers and micro, small and medium enterprises, for economic empowerment.